- Add to favorite

- Wechat

- Corporate Email

- CN

- EN

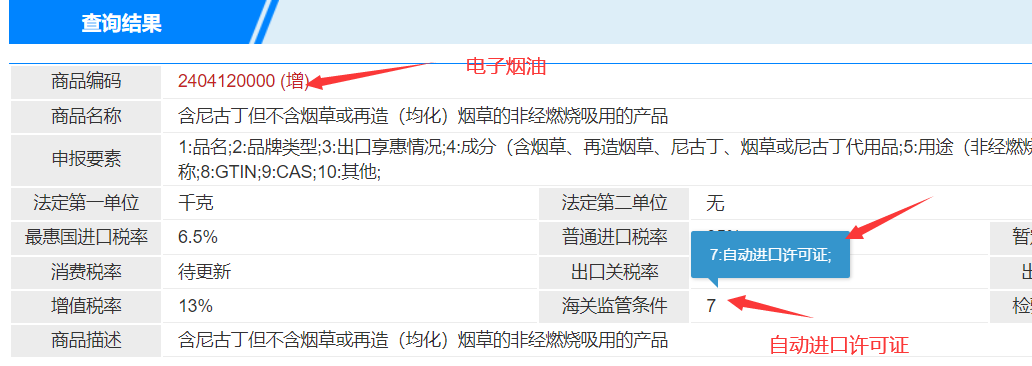

Electronic cigarette oil HS code 2404120000

Since January 1, 2022, all electronic cigarette oil imports must use the product code 2404120000, which involves an automatic import license. That is to say, it cannot be imported casually like before. Before importing goods, a license must be obtained before customs declaration can be made.

Applying for an automatic import license requires certain qualifications, otherwise it is not possible to apply.

Process: First, check the qualification of the import recipient - apply for an automatic import license account - submit the application - agree to approve

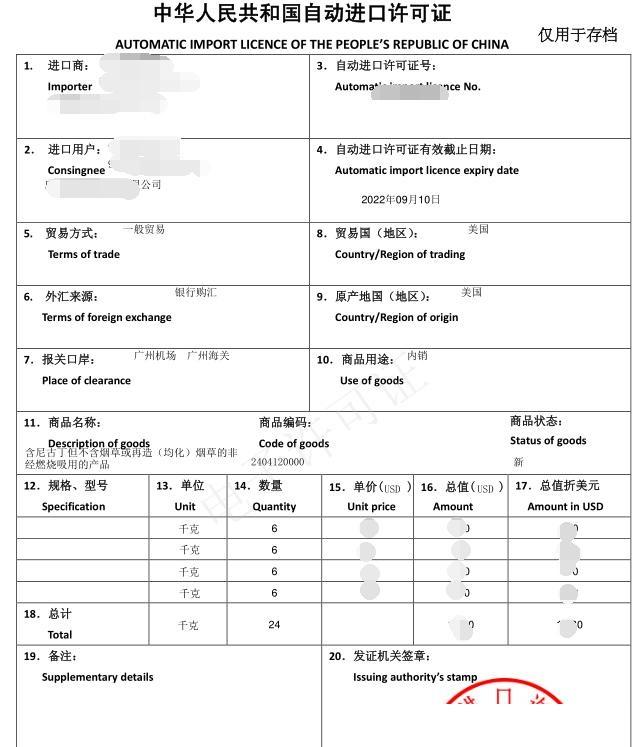

Automatic Import License Template:

Electronic Cigarette Oil Automatic Import License

Shen Gongwang Security: 44030602006947

Shen Gongwang Security: 44030602006947

报价二维码